When times are tight, even reasonable purchases can quietly turn into financial burdens. Maybe it’s a tighter budget, maybe your job’s gotten a bit shakier, or maybe you’re just trying to be smart with your cash. Economic downturns don’t always arrive with flashing warnings, but their impact shows up fast-in layoffs, tighter credit, and slower business. That’s why avoiding high-risk or nonessential spending becomes more important than ever.

Here are 15 purchases worth skipping when the economy starts shrinking.

Shiny New Cars

Sure, nothing beats that new car smell, except maybe not having a car payment hanging over your head during a recession. Financing a vehicle means committing to regular payments, which could become difficult if your income takes a hit. Unless your current ride is falling apart, consider driving it a bit longer or going for a used one.

Bigger Homes with Bigger Headaches

Credit: Getty Images

Moving into a bigger house sounds appealing, especially when prices soften. Even though you’re moving up in the world, a larger home comes with bigger bills, such as mortgage, taxes, and utilities. It might be smarter to stay put and stretch your legs elsewhere.

Home Renovations That Can Wait

Credit: Getty Images

We all love a dream kitchen. But remodeling during an economic slump can be a game of cost overruns and supply delays. If the renovation’s more about aesthetics than necessity, hit pause. Your 2006 countertops can hang in there a little longer.

Luxe Vacations

Credit: Getty Images

Splurging on a high-end getaway is tempting when life feels stressful, but the cost can undercut financial security. With so much uncertainty, now isn’t the time to drain savings for a temporary escape. Maybe opt for low-key local getaways or staycations instead. Your wallet will thank you, and hey, no jet lag.

Second Homes or Vacation Rentals

Credit: Getty Images

A second home sounds glamorous until you’re juggling property taxes, maintenance, and a part-time landlord gig in a down market. Recession conditions often mean fewer travelers and lower rates that make it harder to even break even.

Fancy Gadgets You Don’t Need

Credit: iStockphoto

That new OLED TV or ultra-light laptop isn’t going anywhere. Tech prices fluctuate, and newer models always arrive. During economic slumps, it’s better to preserve cash or redirect funds into high-priority expenses. Only replace electronics if essential for work or communication.

Subscription Overload

Credit: Canva

Do you really need five streaming services, a gym membership, beauty boxes, and that meditation app you forgot you subscribed to? A quick audit of your monthly charges might reveal some quiet cash leaks you can easily plug.

Designer And Name-Brand Clothing

Credit: Getty Images

If your wardrobe is in decent shape, skip trendy or high-priced pieces for now. Sales and discount retailers can meet any immediate needs without damaging your budget. No shame in rocking something classic while your bank account breathes.

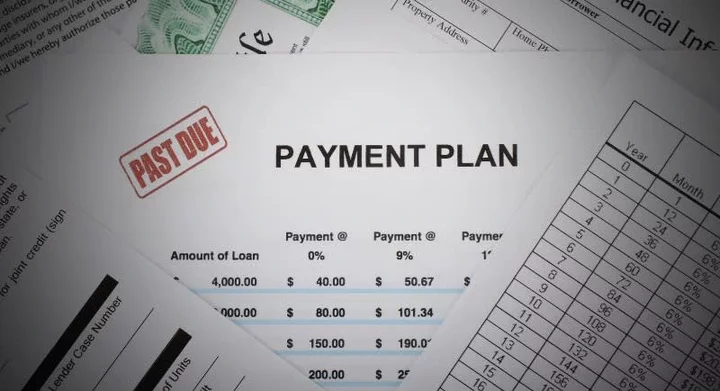

Items That Require Installment Plans

Credit: Getty Images

Spreading out payments can seem convenient, but it often masks how expensive the purchase really is. During a downturn, adding liabilities (even small ones) can pile up fast. If you can’t afford something outright, it’s worth questioning whether you need it at all right now.

Pricey Schools with Cheaper Equivalents

Credit: Canva

Private education can be great, but only if it’s financially sustainable. If there’s a solid public or lower-cost alternative, it’s worth a shot. Tuition loans can be particularly risky when job security is uncertain.

Refinancing Without a Clear Win

Credit: Getty Images

Refinancing can save money if you lock in a good deal. But during volatile times, you might just be swapping one headache for another. Don’t jump unless the math makes sense and the fine print’s in your favor.

Personally, Backing Business Loans

Credit: Getty Images

Offering your own assets as collateral for a company loan can backfire if the business struggles. A recession significantly increases that risk. Putting your name on the line for your business can be a heavy bet. Avoid guaranteeing loans unless you’re prepared to personally cover repayments in a worst-case scenario.

Impulse Grocery Splurges

Credit: Canva

A few extras here and there are no biggie. But when you’re grabbing truffle cheese and imported cookies every week, the bill sneaks up. Stick to a list, choose store brands, and leave the gold-leaf olive oil on the shelf.

High-End Convenience Upgrades

Credit: pexels

Smart appliances, robot vacuums, and luxury coffee makers are fun, not fundamental. They’re easier to justify during boom times, not when income is fragile.

Investments Made on a Hunch

Credit: pixabay

Stock picks based on hype or speculative timing are especially risky in turbulent markets. “Animal spirits” tend to drive these decisions. Focus instead on long-term plans, diversified holdings, and sticking with what you understand. Avoid panic buying or selling.